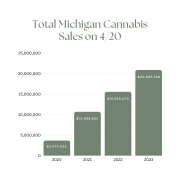

Michigan’s cannabis tax revenues jump tenfold in 2021

GrownIn Magazine shares that the perennial campaign issue of fixing Michigan’s roads got easier thanks to legal cannabis because 2021 brought a nearly tenfold increase in Michigan’s cannabis tax revenue for Michigan over the previous year:

GrownIn Magazine shares that the perennial campaign issue of fixing Michigan’s roads got easier thanks to legal cannabis because 2021 brought a nearly tenfold increase in Michigan’s cannabis tax revenue for Michigan over the previous year:

In 2021, the sales tax collected, which includes both the 6% charged for adult use and medical, totaled $115,462,347. Meanwhile, the adult-use’s additional 10% excise tax added up to $131,195,173 that same year. Bringing 2021’s total cannabis revenues to $246,657,520.

Legal cannabis operators in Michigan are required to pay two main taxes: a 6% sales tax for both medical and adult-use marijuana and a 10% excise tax for adult-use cannabis retailers and microbusinesses. In addition, municipalities hosting cannabis businesses can charge up to $5,000 in annual fees.

…The largest chunk – the 10% excise tax on adult-use marijuana – must be divided according to state law. Fifteen percent, or $19,679,275, went to municipalities where a marijuana retailer or microbusiness is located, allocated in proportion to the number of retailers and microbusinesses in the municipality. Another 15% went to counties with retailers and microbusinesses, as well. Thirty-five percent or $45,918,310 went to a school aid fund for K-12 education, and another 35% went to the Michigan transportation fund to be used to repair and maintain infrastructure.

In March 2021, the first adult-use marijuana payments were distributed to the state’s municipalities and counties, according to a press release. At the time, the Treasury doled out $10 million to more than 100 municipalities and counties, which included 38 cities, seven villages, 21 townships and 38 counties at the time. The largest chunk – $616,029 – went to Washtenaw County, which has 22 licenses.

Lots more in GrownIn.

photo for artwork courtesy TireZoo on Flickr